Can I use a credit card to help build my credit score?

If you use it responsibly, yes you can. It's one way of showing lenders how you manage your finances.

How can a credit card help your score?

1. It can show you have available credit

Credit reference agencies check how much credit you have available and how much you’ve used. This is your credit utilisation ratio. It can help to be using less than 25% of your available credit.

2. It builds up your borrowing history

Every lender wants a responsible borrower. If you show you can manage credit well over time, it may help your score. Having an account for a long time may suggest you are financially stable.

How can a credit card bring down your score?

If you’re thinking about applying for credit cards, try checking your eligibility before making a full application.

Keep reading

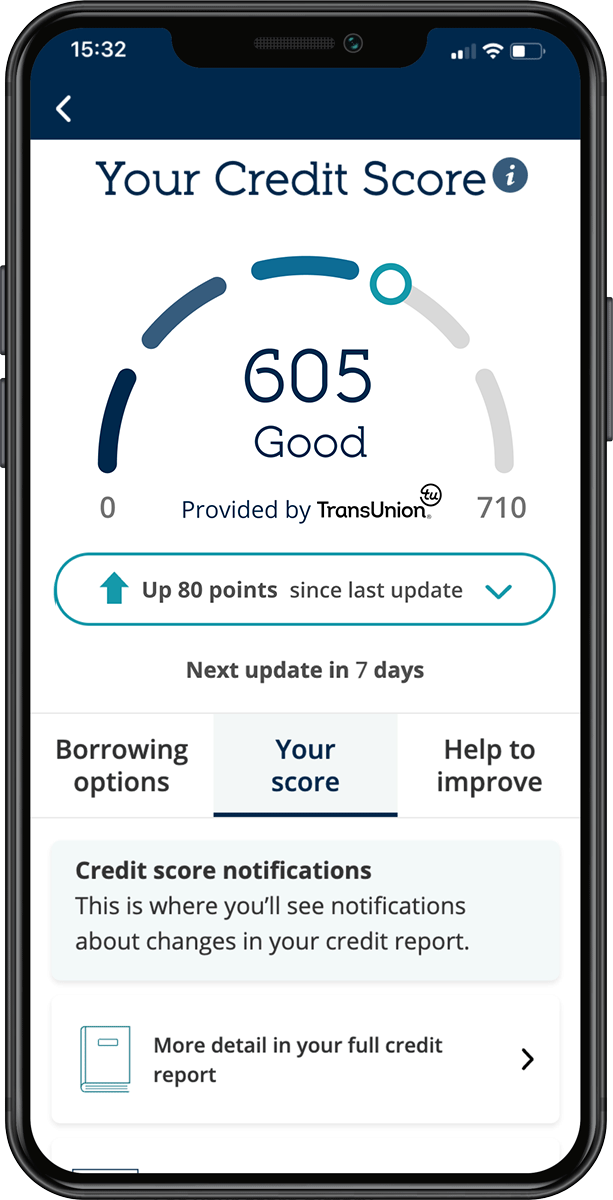

Know where you stand with MBNA

Sign up for ‘Your Credit Score’. We’ve partnered with TransUnion to provide you with access to your credit score. It’s free to use and won’t impact your credit file.

- View your updated credit score every 7 days.

- See what you’re doing well.

- Understand what you can do that might help to improve your score.

- Find out how your score compares to the UK average.