What is APR?

APR stands for Annual Percentage Rate. So, what does that mean?

The cost of borrowing

APR is the total cost of borrowing money over a year and can be useful when comparing credit products, for example credit cards and loans.

At a glance:

- The higher the APR, the more expensive it is to borrow.

- The lower the APR, the less it will cost you to borrow.

-

Helping you understand APR.

Helping you understand APR – Annual Percentage Rate – is an indication of how much your borrowing will cost over the year.

The higher the APR, the more it’ll cost you to borrow.

APR includes the interest paid on borrowing … as well as any other fees, such as an application fee or annual or monthly fees.

It doesn’t include all charges … such as fees for cash withdrawals or late payments.

You might have heard the term ‘Representative APR’

This simply means the rate that most people can expect to be offered. It’s not guaranteed for everyone … but it can help you compare different cards from different providers

Some cards may have a higher interest rate, with no additional fees.

Or it may offer lower interest but then charge for every year you have the card … although sometimes these types of card may come with additional benefits.

Remember to consider your options so you can pick a card that’s right for you.

Let’s go over the key points to understanding APR.

The APR includes interest paid on borrowing, as well as fees.

The higher your credit card’s APR, the more it’ll cost you to borrow.

Representative APR is helpful for simple comparisons.

MBNA – choices made simple.

APR is...

Interest

The credit interest rate.

+

Fees

Any annual and monthly account fees are included.

=

APR

The cost of borrowing over a year shown as a percentage.

The difference between interest rates and APR

An interest rate is just one part of the cost of borrowing. APR includes interest rates as well as other costs that may also come with taking out credit. So, an APR can give you the bigger picture.

Why look at a representative APR?

It can be easier to compare credit products with a representative APR. Things like account fees could push an APR up, but there may be additional benefits that come with those fees. So it’s important to check all the details before deciding on the right credit product for you.

Take a look at this example credit card comparison:

|

Example |

Amount borrowed |

Interest rate on standard purchases (variable) |

Account fee |

Representative APR |

|---|---|---|---|---|

|

Example Credit card A |

Amount borrowed £1,200 |

Interest rate on standard purchases (variable) 18.94% p.a. |

Account fee £0 |

Representative APR 18.9% |

|

Example Credit card B |

Amount borrowed £1,200 |

Interest rate on standard purchases (variable) 18.94% p.a. |

Account fee £195 each year |

Representative APR 69.6% |

FAQs

-

Representative APR gives you an idea of how much it will cost to borrow over a year. AER or Annual Effective Rate, is used to show what you would earn in interest from different savings accounts over a year. AER makes it easier to compare savings accounts that might have differences between them. It’s a bit like how APR works for borrowing products, such as credit cards and loans.

-

No. Your circumstances and borrowing history can influence how much it would cost you to borrow. At least 51% of applicants receive the advertised Representative APR. Lots of lenders offer ways to check your eligibility, so even if you don’t get the Representative APR you may be offered a different rate.

Check your credit card eligibility with MBNA using our quick Clever Check.

-

APR is useful for making comparisons between credit products. But you should always look at the full picture, and your personal situation. Can you afford the repayments? And have you accounted for any extra fees and charges?

Keep reading

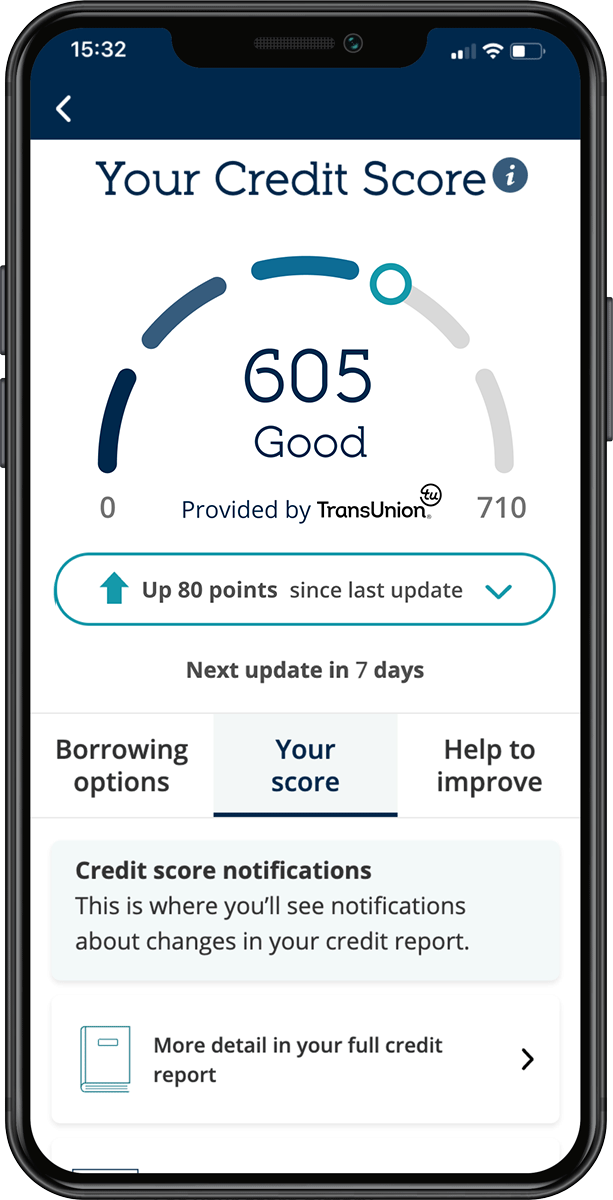

Know where you stand with MBNA

Sign up for ‘Your Credit Score’. We’ve partnered with TransUnion to provide you with access to your credit score. It’s free to use and won’t impact your credit file.

- Your score will be refreshed every 7 days to help you stay on top of your finances.

- See what you’re doing well.

- Understand what you can do that might help to improve your score.

- Find out how your score compares to the UK average.