What is a good or bad credit score?

What is a good or bad credit score?

-

Excellent

Very good

Good

Fair

Low

Excellent

1,121 - 1,250

Very good

1,001 - 1,120

Good

861 - 1,000

Fair

641 - 860

Low

0 - 640

-

Excellent

Very good

Good

Poor

Very poor

Excellent

811 - 1000

Very good

671 - 810

Good

531 - 670

Poor

439 - 530

Very poor

0 - 438

|

Excellent |

Good |

Ok |

Needs some work |

Needs work |

|---|---|---|---|---|

|

Excellent 628 - 710 |

Good 604 - 627 |

Ok 586 - 603 |

Needs some work 551 - 585 |

Needs work 0 - 550 |

What are the benefits of a good credit score?

- The higher your credit score is, the more likely it is for a credit application to be accepted

- You’re more likely to be offered the most favourable and lowest interest rates

What are the disadvantages of a bad credit score?

- You might not be offered the credit limit you need

- It might mean you can’t get a job in some sectors, like legal or financial services

How to check your credit score and report

Checking your score and what information is held about you before you apply for credit is always sensible. Get a copy of your file from all three UK credit reference agencies below to get a full picture. And if you notice anything reported incorrectly, you could submit a data dispute to the relevant agency. They’ll then investigate with the lender. If the lender confirms an error has been made, they can correct it.

The three main UK credit reference agencies are:

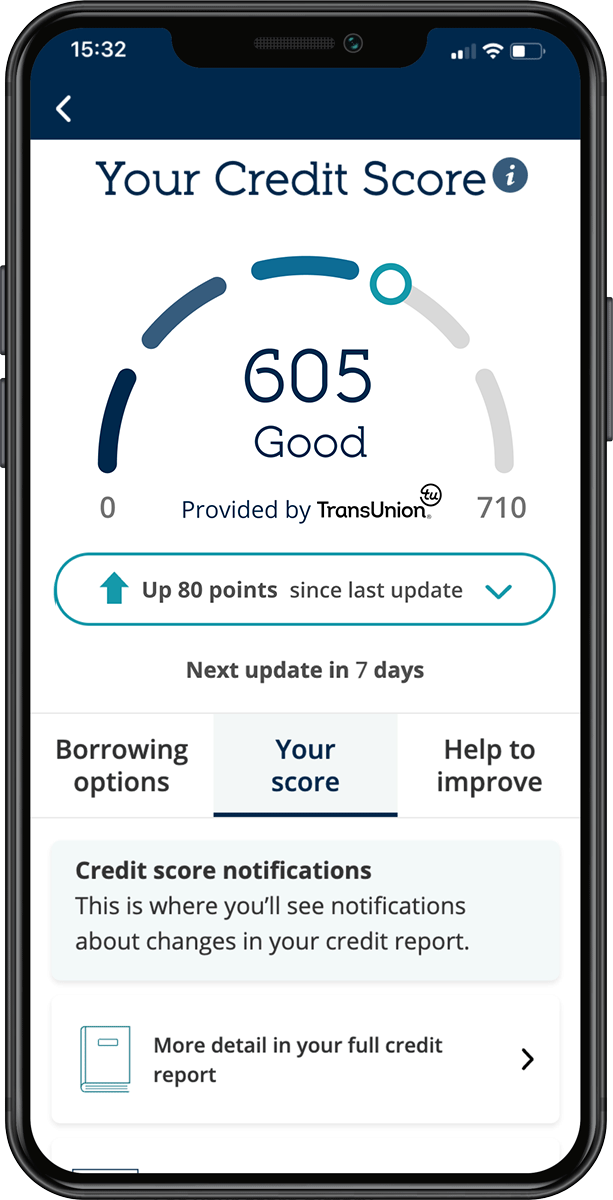

You can also check Your Credit Score with MBNA

Do lenders check anything else?

Know where you stand with MBNA

Sign up for ‘Your Credit Score’. We’ve partnered with TransUnion to provide you with access to your credit score. It’s free to use and won’t impact your credit file.

- View your updated credit score every 7 days.

- See what you’re doing well.

- Understand what you can do that might help to improve your score.

- Find out how your score compares to the UK average.