Understanding credit

Get handy information to help you better understand borrowing.

Starting with the basics

There’s more than one type of credit and understanding the different options available can help you decide what’s right for you.

-

Helping you understand credit – what is a credit score?

If you’re applying for a credit card, personal loan or mortgage, lenders will usually check your credit file to:

assess your circumstances

highlight potential risks

decide on the interest rates and credit limit they’re prepared to offer.

So, if you have a good payment history on all your accounts and low outstanding debts, you may have a higher credit score … which means you’re more likely to be seen as a lower credit risk.

Usually, a higher credit score gives you a stronger chance of being approved for credit, with a higher credit limit and at a better interest rate.

To work out the risk of lending to you, a lender usually checks a number of things, such as:

details on your application form

how you’ve managed your accounts in the past

and information from credit reference agencies.

This is then taken into account as part of their ‘credit worthiness’ assessment. Then they’ll decide whether to lend to you, and on what terms.

Credit reference agencies usually hold information on people’s identity, address and personal financial history. They get some of their information from public records and other lenders.

Some ways you might be able to improve your credit score are:

make sure you’re on the electoral register

check that all your details are correct

manage your accounts effectively

pay bills and credit on time

don’t go over your credit limit

avoid applying for lots of credit in a short space of time.

Many lenders offer eligibility checkers. Ours is called Clever Check and it’s available online or on the MBNA Mobile App.

It can help you find out which credit cards you might be eligible for before you apply – without affecting your credit score – and there’s no obligation to apply for a credit card afterwards.

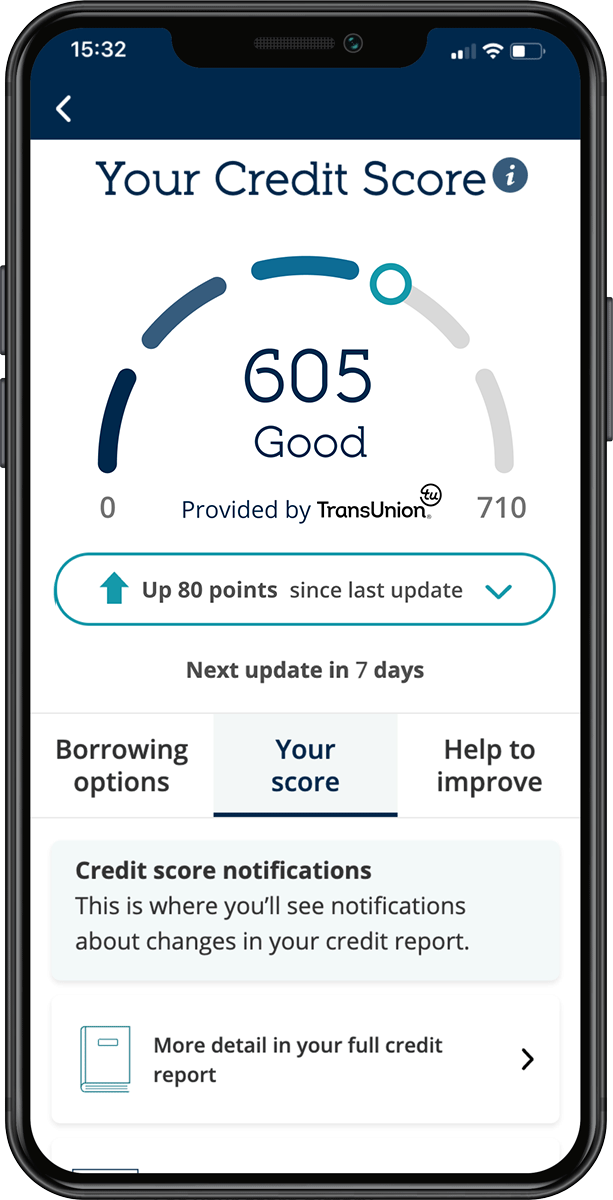

You can check your TransUnion credit score for free on the MBNA app, view your full credit report, and get regular hints and tips on how you could improve or maintain your score.

MBNA – choices made simple.

-

What it costs to borrow

Lenders will usually charge interest as a percentage of the amount you borrow. There may also be extra fees and charges. Always read the terms and conditions of any potential agreement to understand the costs involved.

-

Before you apply

It’s important to work out what you can afford. Can you make the monthly repayments, including any extra fees or charges?

There are different ways of borrowing. Take a closer look at the borrowing options we have available.

What do lenders looks for?

When you apply for credit, lenders must review how reliable you are with borrowing. They may use a credit reference agency or conduct their own checks.

Understanding credit scores

All about your credit score

Check your credit score for free

Sign up for ‘Your Credit Score’. We’ve partnered with TransUnion to provide you with access to your credit score. It’s free to use and won’t impact your credit file.

- View your updated credit score every 7 days.

- See what you’re doing well.

- Understand what you can do that might help to improve your score.

- Find out how your score compares to the UK average.

Online Services: We don’t charge you for Online Services but your mobile operator may charge for some services, please check with them. Available to Online Services customers with a valid registered phone number.

Our app is available to iPhone and Android users only and minimum operating systems apply, so check the App Store or Google Play for details. Services may be affected by phone signal and functionality. Our app does not work on jailbroken or rooted devices. Device registration required.

Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Google Play is a trademark of Google LLC.

Terms and conditions apply.